It is advisable for consumers to review their credit reports frequently to stay knowledgeable about the information they contain. Consumers can review each of their credit report disclosures weekly for free at www.annualcreditreport.com This is the only official website authorized by law for this purpose. Not every credit grantor reports information to each credit bureau all the time, so consumers should be sure to review each report at least once per year to get their complete picture.

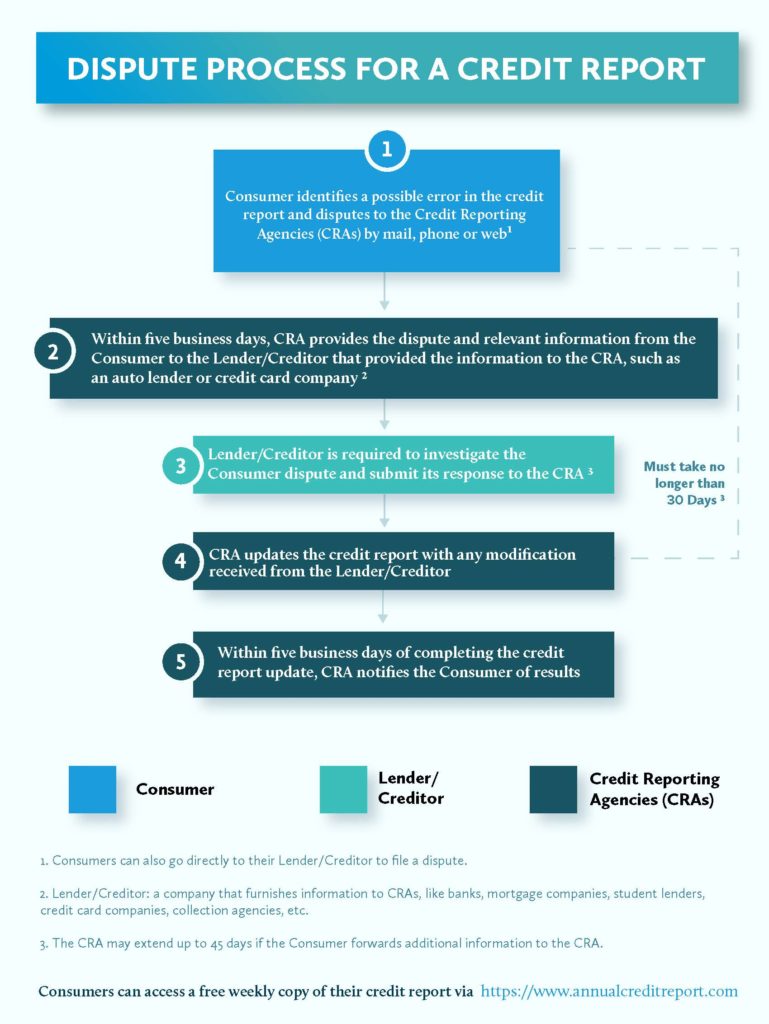

If a consumer finds something in one or more of those reports that they believe might be incorrect, they can contact the creditor and try to resolve the issue directly, or contact the corresponding consumer reporting agency to initiate what is known as a “Dispute” with that creditor on their behalf. The three nationwide consumer reporting agencies (CRA)—Equifax, Experian and TransUnion—each have an online dispute process which guides consumers through the steps needed to submit the item(s) they wish to have investigated. Disputes can also be submitted by mail or contact the bureau by phone if preferred. Under the Fair Credit Reporting Act, the CRA has a certain amount of time—generally 30 days but up to 45 days in certain circumstances—to resolve a dispute. If the item cannot be verified by the creditor within the time frame, it will be removed from the report. Another way the information might be removed is if the creditor either does not respond within the allotted time frame or confirms that the item is not accurate. However, if the creditor verifies that the item is accurate and is the consumer’s responsibility, then it will remain on the credit report as part of their credit history.

Once the bureau completes its dispute investigation, the consumer will be notified of the results. If they feel the investigation has not resolved theiur concerns, or they wish to provide clarification about an item or items, the consumer may add a 100-word statement which will be included in every credit report the bureau issues about them.

Helpful Tips

- Consumers can review each of their 3 credit reports weekly to ensure accuracy

- www.annualcreditreport.com is the only website authorized by Federal Law for this purpose

- If a potential inaccuracy is identified, consumers should contact the creditor or file a dispute with the consumer reporting agency

- Once a dispute investigation is completed, the consumer reporting agency will notify the consumer of the results